| Want to send this page or a link to a friend? Click on mail at the top of this window. |

More Special Reports |

| Posted March 6, 2006 |

| The Real Estate Issue |

|

|

Charts by Sarah Gephart |

WHO NEEDS |

|

THE |

|

MORTGAGE- |

|

INTEREST |

|

DEDUCTION? |

MOST PEOPLE THINK OF THE TAX BREAK ON MORTGAGE INTEREST AS FAIR SOCIAL POLICY INTENDED TO MAKE HOMEOWNING CITIZENS OF US ALL. THEY ARE WRONG. |

|||

|

ONE OF THE FIRST FINANCIAL lessons I learned from my father was that when you buy a house, you get a tax break from deducting the interest on your mortgage. Therefore, he would explain as if it were as natural as pivoting at second base on a throw from shortstop, a person could afford to pay more for a house that he owned than he would on a residence that he was only renting and on which he didn't get the tax break.

I didn't know why the government had chosen to influence my decision in this manner, and even less did I consider how it might affect the people on the other side — the people who might be selling me a house, or lending me the money, or, for that matter, the guy who might have liked to have rented me an apartment if the Internal Revenue Code hadn't been tilted against him.

But it was a lesson I took to heart. When I was considering buying my very first dwelling, a 1BR w/EIK on West 79th Street with, for those who were sufficiently agile, a faint glimpse of the Hudson River, I vaguely remember that I scratched out the monthly cost of the mortgage payment, after which Dad made some quick calculations to demonstrate that the "after-tax cost" of the mortgage actually was within my budget.

From then on, deducting the interest became an indispensable tactic (in fact, it was the only tactic I had) in my forays into real estate. The houses got steadily bigger, and so did the mortgages. Last year, when my new wife and I bought a modern colonial in suburban Boston that was intended to accommodate a majority of the children we had accumulated from our first marriages, not to mention a plurality of our itinerant relatives, I took out an "interest only" mortgage, a big attraction of which was that the payments (all interest, no principal) were entirely deductible.

By then, I did know something about what the government was up to. Or at least I thought I did. Some fellow in the Treasury Department had long ago decided it would be a good thing for families like ours not to suffer through our lives as tenants. In fact, he (whoever he was) decided it would be good for our neighbors and for society in general if we could be owners and not just dwellers. In early America, only those who owned property were eligible to vote, and the notion that tenants were only provisional citizens, or at least had a lesser stake in things, has somehow endured. According to studies, people who own their homes take better care of them; they fix the roof more often and plant more lilacs. They join more clubs and community groups; they vote more often; they move around less often; and their kids do better in school. The government is subsidizing my house so I will do more gardening. Or something like that.

| POJECTED COST TO THE TREASURY |

| OF THE MORTGAGE-INTERESTDEDUCTION: |

But when exactly did the interest deduction begin? I had often heard my father rhapsodize about the G.I. Bill of Rights, which was enacted in 1944, when he was serving in the Pacific, and which a few years later was paying his tuition at law school; the mortgage-interest deduction came to be joined in my mind as an adjunct piece of social policy. One got you an education and the other got you a house: together, they bought entree to the middle class.

Since the great migration to the suburbs also occurred after World War II, I assumed that the interest deduction was of a similar postwar vintage. Over the years, it has become an American folk legend: the government invented the mortgage-interest deduction to help people buy their own homes, and the level of homeownership has risen ever since.

What part of the legend is true? Basically, none of it.

Economists don't agree on much, but they do agree on this: the interest deduction doesn't do a thing for homeownership rates. If you eliminated the deduction tomorrow, America would have the same number of homeowners, the same social networks, the same number of gardens.

The deduction might help some people (like me) to purchase bigger homes than they otherwise would. And it certainly helps people who are selling mansions to get a higher price. But it is hardly the democratic subsidy people think. In fact, it's patently regressive.

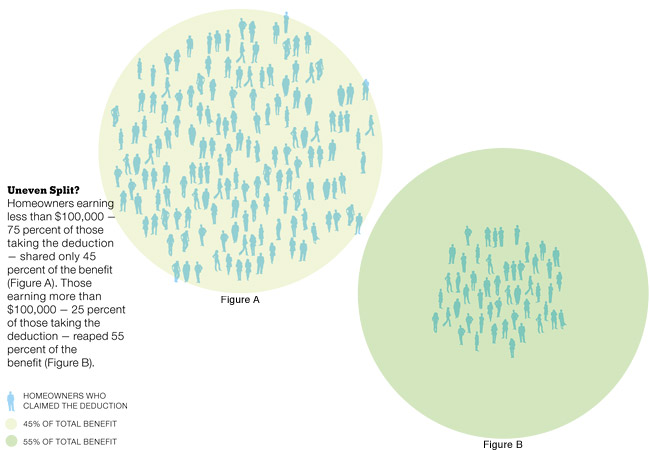

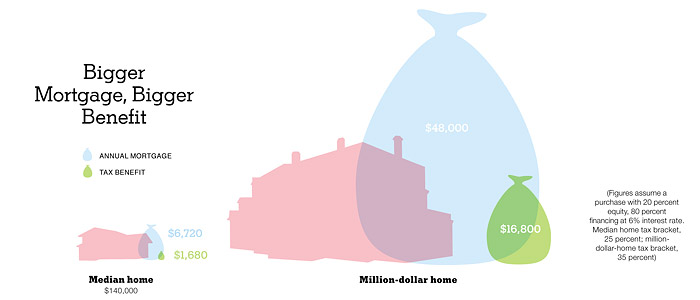

More than 70 percent of tax filers don't get any benefit from the deduction at all. O.K., many of them are renters. But even among homeowners, only about half claim the deduction. And for the 37 million individuals and couples who do, the rewards, at least on average, are surprisingly modest — just under $2,000 per return. (Figure it like this: the median home, as computed by the Bureau of the Census in 2003, is valued at $140,000. If you finance 80 percent of it with a 6 percent mortgage, your interest bill is $6,720 a year. A taxpayer in the 25 percent bracket would save one quarter, or $1,680.)

| $76BILLION |

But cumulatively, the deduction is a big deal. This year, it is expected to cost the Treasury $76 billion. And the rewards are greatly skewed in favor of the moderately to the conspicuously rich. On a million-dollar mortgage (the people with those really need help, right?), the tax benefit is worth approximately $21,000 a year. And according to the Joint Committee on Taxation, a little over half of the benefit is taken by just 12 percent of taxpayers, or those with incomes of $100,000 or more.

This is a social policy? It's hard to imagine that Congress would intentionally legislate such a rich-get-richer handout, but the origins of the deduction are so obscure that the myth about it persists. David Lereah, chief economist for the National Association of Realtors, explained the history of the deduction by observing matter-of-factly: "Homeownership is something this country desires. If you read the tax codes over the last 100 years, you'll see the favoring of the housing sector and all the reasons Congress was giving for it." Congress has indeed done plenty of things over the years to support homeownership, but the deduction wasn't one of them. That mole in the Treasury Department who invented the deduction so I could buy a house — he never existed. In fact, as Steven Bourassa, of the University of Louisville, and William Grigsby, at the University of Pennsylvania, wrote in "Housing Policy Debate," a Fannie Mae publication, the mortgage deduction "was largely accidental."

THE FIRST MODERN FEDERAL income tax was created in 1894. Interest — all forms of interest — was deductible; the Supreme Court, however, quickly ruled that the tax was unconstitutional. In 1913, the Constitution was amended and a new income tax was enacted. Once again, interest was deductible.

There is no evidence, however, that Congress thought much about this provision. It certainly wasn't thinking of the interest deduction as a stepping-stone to middle-class homeownership, because the tax excluded the first $3,000 (or for married couples, $4,000) of income; less than 1 percent of the population earned more than that. The people paying taxes — Andrew Carnegie and such — did not need the deduction to afford their homes or their yachts.

There is another reason Congress could not have had homeownership in mind. The great majority of people who owned a home did not have a mortgage. The exceptions were farmers. But most folks bought their homes with cash; they had no mortgage interest to deduct.

When Congress made interest deductible, it was probably thinking of business interest. Just as today, the aim was to tax a business's profits after expenses had been netted out, and interest was an expense like any other. In a nation of small proprietors, basically all interest looked like business interest. Whether it was interest on a farm mortgage, or interest on a loan to purchase a tractor, or interest charged to a general store that purchased its inventory on credit, it all would have looked like a business expense. Credit cards did not exist. So Congress just said, "Deduct it."

It was not until the 1920's and the spread of the automobile that home mortgages outnumbered farm mortgages. In the 1930's, the mortgage industry got a huge assist from the feds — not from the tax deduction, but from agencies like the Federal Housing Administration, which insured 30-year loans, and, over time, the newly created Federal National Mortgage Association, or Fannie Mae. Before then, the corner bank would issue a mortgage and wait for the homeowner to pay them back; now savings and loans could replenish their capital by selling their mortgages to Fannie Mae — meaning they could turn around and issue a new mortgage to someone else.

By the time the G.I.'s returned from World War II, bursting with dreams of homeownership, the mortgage industry was ready for them. It wasn't until after 1950 that the majority of homeowners had mortgages. And thanks to this ready financing, renters suddenly became owners. After hovering around 45 percent for the first half of the 20th century, the proportion of owner-occupied homes soared. By 1960, 62 percent of Americans owned their homes. (Today, the figure is only slightly higher: 69 percent.)

Of course, it was in those postwar years, when people were getting their first mortgages and also their first homes, that Americans discovered the joy of the interest deduction. Over time, it evolved into a birthright — almost like owning a home itself. Perhaps it was that confluence of trends that led people to suppose, as Daniel Gross did last year in the online journal Slate, that the U.S.'s "enviably high rate of homeownership" is a product of the deduction. But the existence of credit was a much greater catalyst than the longstanding ability to deduct it. Homeowners who genuflect to the deduction should probably be giving their thanks to mortgage bankers instead.

In any case, the growth of credit cards in the 70's began to turn the interest deduction into a serious loophole. People were becoming plastic junkies; if you paid for a washing machine on credit, the I.R.S. would give you a subsidy. By the 1980's, this threatened the entire system of revenue collection. There was some talk that the Treasury was looking at eliminating deductions, including, possibly, the interest deduction. Economists thought it was a good idea. "Tax economists tend to be skeptical about preferences in the tax," says Joseph Thorndike, the director of the Tax History Project at the nonpartisan Tax Analysts. "Are they targeted to the right people? We give tax breaks for college; do we send more kids to college or help middle-class kids who are going to college anyway?" Fine and well, but was an elected official really going to risk fooling with the mortgage deduction?

President Reagan was not. Addressing the National Association of Realtors in 1984, he said, "I want you to know that we will preserve the part of the American dream which the home-mortgage-interest deduction symbolizes." He didn't mention that it also symbolized the American love affair with debt; after all, it encourages people to pay for their homes with a mortgage instead of with equity. Two years later, in the tax-reform act of 1986, Congress ended the deductibility of interest on credit-card and other consumer loans; it left the mortgage deduction in place.

|

But Congress did set a cap. Today, a taxpayer can deduct the interest on mortgages worth up to a total of $1 million on his or her first or second homes. Also, you can deduct up to $100,000 on a home-equity loan. (And what prevents you from using a home-equity line to buy a flat-screen TV and then deducting the interest? Absolutely nothing; go for it.)

At the beginning of 2005, flush from his election victory, President Bush envisioned another major tax reform, somewhat similar to that of 1986. Simplifying the tax code was a major goal, as was winnowing out the tax breaks that were again eating a hole through the Treasury. Bush appointed a nine-member, bipartisan panel to drum up a proposal. The president ordered the panel to "recognize the importance of homeownership." People figured the interest deduction was off limits.

'WHY WOULD YOU WANT AN ABNORMALLY LARGE SUBSIDY FOR PEOPLE WHO HAVE ABNORMALLY LARGE MORGAGES?' ASKS A FORMER I.R.S. COMMISIONER. |

But the panel, with former Senator Connie Mack III as chairman, asked the taboo question of whether homeownership and the interest deduction were related. It decided that they weren't.

One reason is that homeownership in the U.S. is about the same as it is in Canada, Australia and England, where interest isn't deductible. Another reason is just common sense. If you want to increase homeownership, you have to do something so that renters become owners. But just over two-thirds of all taxpayers, including most renters, don't itemize their deductions, generally because they don't earn enough; they simply take the "standard deduction." The mortgage deduction doesn't help them.

Most taxpayers who do itemize come from the wealthiest one-third; they would own a home regardless. Some have been using the deduction to buy boats ("houseboats," for accounting purposes). The panel wasn't interested in helping people buy boats or palatial estates. "Why," asks Charles Rossotti, a former I.R.S. commissioner and panelist, "would you want an abnormally large subsidy for people who have abnormally large mortgages?"

The panel's charge was to make the tax code simpler and "fairer" while keeping it as progressive as it is now — and without, on a net basis, losing any revenue. Bush also wanted it to be pro-growth, not surprisingly, and thus the panel resolved to reduce the scope of the Alternative Minimum Tax, a sort of shadow tax that has come to be levied on more and more filers every year and that confuses just about everyone who has to pay it.

But to eliminate the A.M.T., the experts on the panel had to find an alternate source of revenue. The most obvious place was what the Joint Committee calls "federal tax expenditures" — deductions and loopholes that cause the Treasury to lose revenue. The Joint Committee produces a list of such expenditures; it runs for many pages and it is a fearsome document.

The tax code currently helps (in no particular order) veterans, the disabled and Americans living abroad; it gives a break to science research, oil and gas developers, alcohol-fuel blenders and biodiesel blenders; it helps agriculture and dairy farms; it helps Blue Cross and Blue Shield; it helps film companies and railroads; it helps students and teachers; it assists New Yorkers and District of Columbians and Native Americans and many, many others. The interest deduction is one of the biggest breaks, right behind health-care premiums paid by corporations, which are tax-free to the employees. A slightly different type of exemption protects corporate retirement plans. In all, such foregone tax collections, or tax expenditures, amount to more than half of the income tax that the Treasury does collect.

In the panel's view, though many or most of the deductions help some worthy individual or group, they come at a large total cost to everyone else. And so, last November, the panel did what had been asked of it: it proposed a simplified tax code with fewer deductions and, in return, lower individual and corporate rates and an end to the A.M.T. The proposal included a thunderbolt: the U.S. should scrap the mortgage-interest deduction and replace it with a smaller tax credit, available to every homeowner.

Under the panel's scheme, taxpayers would receive a credit equal to 15 percent of their mortgage interest. However, the credit would be capped at a level at which the owner of an above-average-sized home could take full advantage. The maximum break would be several thousand dollars a year, and only principal residences — not ski condos — would qualify.

RESEARCH SUGGESTS THAT WITHOUT THE DEDUCTION, PEOPLE WOULD STILL BUY HOUSES; THEY WOULD JUST COST A LITTLE LESS. |

The panel's courage was met with predictable howls of protest. Real-estate agents screamed that ending the sacred interest deduction would set off a slump in the housing market — a pillar in an otherwise weak economy and so forth. Donald Trump, who knows everything, said that eliminating the deduction would result in "a total catastrophe" for the U.S. economy. "It will lead to a major recession, if not a depression."

The panel considered this. It also debated the uniqueness of the deduction — a tax provision that has become embedded in mainstream culture — but in the end, according to James Poterba, an economist from the Massachusetts Institute of Technology, "We wanted to wipe the slate clean." The package, he and the others surely hoped, would be judged on its overall equity, not on a provision-by-provision basis.

Since 1986, there have been some 15,000 amendments to the tax code, always to help some interest or other but each time distorting free-market incentives. To an economist, when someone invests for profit, that's good. When they invest to take advantage of a tax break, that's bad. "It's a standard canon of economics," Poterba says. It means that capital is being diverted from its best use, and the economy suffers as a result.

You can think of the mortgage deduction as a distortion that has helped potential home sellers — not buyers or owners — and this is why the housing industry is so agitated. Research suggests that without the deduction, people would still buy the houses they do now; they would just cost a little less. In effect, the market would adjust downward to reflect some of the decrease in buyers' purchasing power. Though no one knows, a plausible estimate is that prices at the upper end of the housing spectrum would fall by 10 to 15 percent. Prices of less expensive houses would probably rise a bit, because people who don't get a break now would get the tax credit and thus could spend a little more.

| BY 1960, 62 PERCENT OF AMERICANS OWNED |

| HOMES. TODAY, THE FIGURE IS ONLY A BIT HIGHER: |

To cushion the impact, the panel recommended phasing the change in over five years. That might not be very palatable if you happened to have just bought (and financed) a seven-figure home, but remember, the extra money paid into the Treasury wouldn't disappear; it would be returned to taxpayers who would no longer be subject to the A.M.T. The money would still be there, only now it would be in everybody's pockets, not just those of luxury homeowners. You wouldn't have to invest in a house to benefit; you could invest where you wanted. That's called a free market.

The real-estate industry logically prefers a protected market to a free one. It argues that capital would drain out of housing. "This is antihousing," says Jerry Howard, chief executive of the National Association of Home Builders. "You will do some serious damage to states with strong vacation economies." You can see why home builders are upset: their margins are fattest on luxury homes; a policy that pushes prices toward the middle, as egalitarian as it might sound, would end their party.

But tax policy was never intended to function as a price support. Even less should it support a putative housing bubble. Even the president's directive mentioned sustaining housing ownership — not sustaining housing prices. High prices may even be a disincentive to ownership. And the housing market, the panel concluded, is overcapitalized anyway. Thanks to the interest deduction and other breaks, the effective tax rate on owner-occupied real estate in the U.S. is estimated to be only a fraction of the tax on business. Some of the capital being plowed into McMansions with Olympic-size lap pools would earn a higher return (tax considerations aside) in medical research or pollution control.

If you scratch deeply enough, not even the real-estate lobby thinks that the interest deduction makes much sense economically. It's just a goody that homeowners, not to mention real-estate agents, have grown used to. Lereah, the economist for the National Association of Realtors, said: "If you're rewriting the book of Genesis, I might have a different approach. But if you make changes in the middle of the game, it's going to have a negative impact of the value of property . . .reduce people's retirement nest egg, funds they have available for college. You're going to cause a great dislocation."

I asked Lereah if we could ever try a new approach — clean the slate — and he repeated that it's too late now to "rewrite Genesis." It would seem that any deduction that survived the biblical Flood is off limits. As absurd as this may sound, Lereah's organization represents 1.2 million real-estate agents, and they have made their displeasure known. Lereah predicted that repeal would be "dead on arrival in Congress." And so, more or less, did everyone else.

The only people who seemed to like what the panel did were other experts, principally economists. Joel Slemrod, at the University of Michigan business school, said: "What they're proposing is a good idea. Owning stocks is good for society, too," he noted, but stockbrokers don't get a handout from the feds. "Right now, our tax code says, 'Don't build a factory, build a mansion,' " says Kevin Hassett of the American Enterprise Institute. "The deduction is the perfect break for bobos in paradise."

Hassett didn't say whether he was referring to elected representatives or to their wealthier constituents, but the purpose of an advisory panel, of course, is to suggest things that mere politicians would not. "There was a feeling that the job of our commission was not to take the political temperature," Poterba told me. "If you can't inject principles into a discussion like this, you never will." Connie Mack, the chairman, actually maintained that the proposal had a chance. He pointed out — as he did to the secretary of the Treasury — that the panel, which included liberals as well as conservatives, had achieved the rare feat of unanimity. He was hoping the secretary would get the ball rolling and that the president would begin a major tax-reform initiative — maybe in the State of the Union. A fine idea. But the State of the Union came and went, and if President Bush was thinking of implementing his panel's agenda — much less of repealing the interest deduction — he didn't get around to saying so. Maybe the president has too much on his plate; maybe he reckoned a financing technique that homeowners have been schooled on by their dads for a couple of generations wasn't an appealing target. "There is a question of what is myth and what is reality," Rossotti, the former I.R.S. commissioner observed. "Some people think we're undermining a fundamental piece of America."

| 69 PERCENT |

A more salable approach would be to kill the deduction in stages, by gradually reducing the $1 million ceiling over many years. Over time, it would simply disappear. Congress could do that; it should do it. The deduction is overrated as an icon, and as tax policy it is misdirected and unfair. But don't hold your breath. Homeownership and a level playing field are always good for a speech. But they are nothing compared with propping up housing prices. And that is what the mortgage deduction is all about.

Roger Lowenstein is a contributing writer. His last article for the magazine was about pensions.

Copyright 2006 The New York Times Company. Reprinted from The New York Times Magazine of Sunday, March 5, 2006.

| Wehaitians.com, the scholarly journal of democracy and human rights |

| More from wehaitians.com |