| Want to send this page or a link to a friend? Click on mail at the top of this window. |

More Special Reports |

| Posted October 26, 2007 |

| REPORTS SUGGEST BROADER LOSSES FROM MORTGAGES |

____________ |

| MERRILL RAISES FIGURE |

____________ |

Drop in Homes Sales - |

2 Million Subprime |

Foreclosures Seen |

____________ |

By VIKAS BAJAJ |

and EDMUND L. ANDREWS |

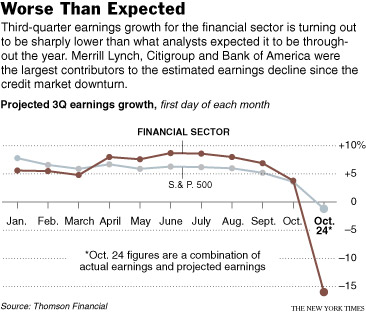

Every time economists and Wall Street executives think they have acknowledged the full extent of the losses from the meltdown in real estate mortgages, more bad news turns up.

Merrill Lynch said yesterday that it would take a charge for mortgage-related securities on its books that is $3 billion more than the $5 billion it expected just two weeks ago. And a report from the National Association of Realtors showed that sales of existing homes in September fell twice as much as economists had expected, to their lowest level in nearly 10 years.

Stocks fell sharply early yesterday on the news, with the Standard & Poor’s 500-stock index falling 1.8 percent before recovering in the afternoon. Investors also bid up Treasuries as they sought the safety of government-backed debt.

At this juncture, economists say the troubles in the mortgage market could, all told, cost financial firms and investors up to $400 billion. That is far more than the roughly $240 billion cost, adjusted for inflation, of the savings and loan crisis of the early 1990s, according to estimates of the combined financial toll of that crisis on both the federal government and private sector.

The loss in total real estate wealth is expected to range from $2 trillion to $4 trillion, depending on how far home prices fall, according to several economists. That would be significantly less than the losses suffered by investors in the stock market collapse earlier this decade, which erased more than $7 trillion, or about 40 percent, of market value.

Experts caution that these estimates are preliminary and the total costs could get bigger still. They also note that the loss of real estate wealth could prove more damaging for the general public than falling stock values because more American families own homes than own stock.

In recent years, the rise in real estate values has helped propel consumer spending, as homeowners refinanced mortgages and took out home equity loans.

“There weren’t a lot of people living off their capital gains from stocks,” said Jane Caron, chief economic strategist at Dwight Asset Management. “There were a lot people using their home as a piggy bank.”

|

|

| _______________________ | |

|

Of course, many people who bought their houses several years ago are still ahead financially, because the sharp run-up in home values is still far greater than the expected decline. Those who bought close to the peak stand to lose the most if they have to sell in the near future.

In a new report to be issued today, the Joint Economic Committee of Congress predicts about two million foreclosures by the end of next year on homes purchased with subprime mortgages. That estimate is far higher than the Bush administration’s prediction in September of 500,000 foreclosures, which in itself would be a tidal wave compared with recent years. Congressional aides provided details of the report yesterday to The New York Times.

The Joint Economic Committee estimates that the lost of real estate wealth just from foreclosures on subprime loans will be about $71 billion. An additional $32 billion would be lost because foreclosed homes tend to drive down the prices of other houses in the neighborhood.

Those figures would cause a decline of $917 million in lost property tax revenue to state and local governments, which will also have to spend more on policing neighborhoods with vacant homes. The states most likely to be hard hit fall into two categories: those where prices had been rising fastest, like California and Florida, and Midwest states with weak economies, like Michigan and Ohio, where people with low or moderate incomes made heavy use of subprime loans to become homeowners and consolidate debts.

“State by state, the economic costs from the subprime debacle are shockingly high,” said Senator Charles E. Schumer, Democrat of New York and the chairman of the Joint Economic Committee. “From New York to California, we are headed for billions in lost wealth, property values and tax revenues.”

Still, subprime mortgages make up a relatively small share of the total housing market — about $1 trillion of the $10 trillion in outstanding mortgages.

The much bigger losses will be in declining real estate prices. Household real estate currently totals about $21 trillion, according to the Federal Reserve.

Global Insight, a research firm, predicts that the national average for housing prices will drop 5 percent over the next year and 10 percent before mid-2009, for a total of about $2 trillion. Economists at Goldman Sachs have predicted prices will drop by 15 percent, meaning an overall decline of more than $3 trillion; other forecasters have said the decline could be 20 percent or more.

House prices decline slowly, because many potential sellers simply stay in their current homes when they think prices are too low. But that becomes more difficult as people have to move either because of job changes or, increasingly, because their monthly payments are rising sharply. In the next 18 months, interest rates on more than two million homes loans will reset to higher adjustable rates.

Inventories of unsold existing homes rose last month to their highest level in almost 20 years.

Economists continue to update their predictions on how the loss of housing wealth might affect the overall economy. Nigel Gault, chief domestic economist at Global Insight, said he assumes that consumers reduce their spending by about 6 cents for every dollar of lost wealth.

If prices drop 5 percent next year, that would mean a decline of $60 billion in spending, all else being equal. That would be a noticeable slowdown, but not enough to cause a recession.

In the last several years, Americans have increased spending faster than their incomes by borrowing against the rising value of their homes. Economists estimate that such mortgage-equity withdrawals may have added one-quarter of a percentage point to consumer spending growth — a boost that could now disappear.

Thus far, spending has climbed more than 3 percent over the last year, and the most recent data on chain-store sales suggests sluggish growth but nothing near levels consistent with a recession.

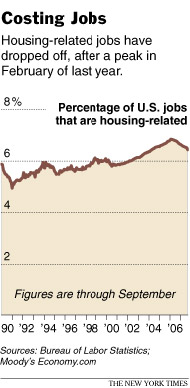

The housing bust has also led to job losses. From the start of 2003 to March 2006, housing-related businesses like mortgage companies, home builders and contractors added 1.3 million jobs, or about 23 percent of all new jobs created in that period, according to an analysis by Mark Zandi, chief economist at Moody’s Economy.com.

Since then, the housing business has shed 383,000 jobs, while the rest of the economy has added nearly three million jobs.

Jan Hatzius, chief United States economist at Goldman Sachs, said the small decline in housing employment thus far is surprising and suggests more layoffs are ahead.

“You still have a million jobs that aren’t really needed anymore due to the downturn in housing,” he said.

D. Ritch Workman, president of the Florida Mortgage Brokers Association, believes he has an explanation. Many of the brokers and loan officers he knows are still working in the industry, even though they have taken on second jobs to make ends meet.

The home-loan company he owns with his brother in Melbourne, Fla., has seen revenue fall by half, to $500,000, and he has laid off two of its three salaried employees. But the firm has added several loan officers, who are paid on commission only, and it now has 18 people making loans.

“I am surprised they have hung in there,” Mr. Workman said. “But it’s a scary thing when that’s all you know. If for 15 years you have been a relatively successful broker and you have lived through the highs and lows, what are you going to do? Most of them are holding on for dear life and hoping things get better.”

On Wall Street, which fueled the housing boom by lending to mortgage companies and packaging and selling home loans, banks are writing off billions of dollars in bad loans and are setting aside billions more for the expected surge in defaults. Late yesterday afternoon, Bank of America said it would lay off 3,000 people across the company and has replaced the head of its investment banking division.

Eric Dash contributed reporting.

Copyright 2007 The New York Times Company. Reprinted from The New York Times, National, of Thursday, October 25, 2007.

| Wehaitians.com, the scholarly journal of democracy and human rights |

| More from wehaitians.com |