| Want to send this page or a link to a friend? Click on mail at the top of this window. |

More Special Reports |

| Posted December 26, 2007 |

Professor Cites Bible in Faulting Tax Policies |

|

|

|

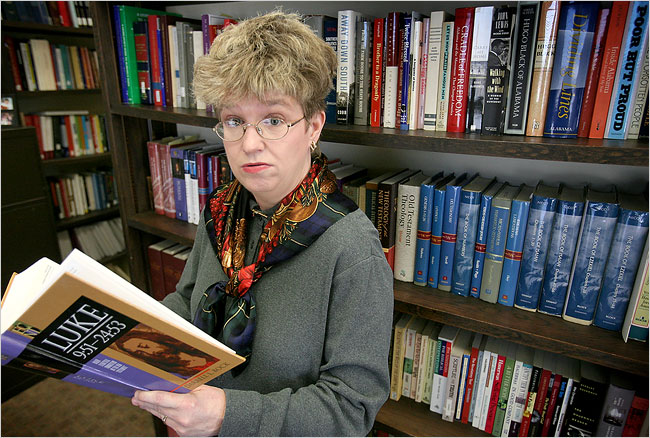

GARY TRAMONTINA FOR THE NEW YORK TIMES |

|

| Prof. Susan Pace Hamill says 18 states, especially Alabama, seriously violate biblical principles in the way they tax and spend. |

By DAVID CAY JOHNSTON |

At a time when some voters are asking how the religious views of candidates will shape their policies, a professor’s discovery of how little tax the biggest landowners in her state paid to finance the government has prompted some other legal scholars to scour religious texts to explore the moral basis of tax and spending policies.

The professor, Susan Pace Hamill, is an expert at tax avoidance for small businesses and teaches at the University of Alabama Law School. She also holds a degree in divinity from a conservative evangelical seminary, where her master’s thesis explored how Alabama’s tax-and-spend policies comport with the Bible.

Professor Hamill says that since Judeo-Christian ethics “is the moral compass chosen by most Americans” it is vital that these policies be compared with the texts on which they are based. Another professor says she is the first to address this head on, inspiring work by others.

Her findings, embraced by some believers and denounced by others, has also stirred research everywhere from Arizona State to New York University into the connection between religious teachings and government fiscal practices.

Her latest effort is a book, “As Certain as Death” (Carolina Academic Press, 2007), that seeks to document how the 50 states, in contravention of her view of biblical injunctions, do more to burden the poor and relieve the rich than vice versa.

In lectures and papers, Professor Hamill has expanded on her theme, drawing objections from some critics who say that the religious obligation to care for the poor is a matter of personal morality, not public policy.

Professor Hamill asserted that 18 states seriously violate biblical principles in the way they tax and spend. She calls Alabama, Florida, Louisiana, Nevada, South Dakota, Texas “the sinful six” because they require the poor to pay a much larger share of their income than the rich while doing little to help the poor improve their lot.

The worst violator, in her view, is her own state of Alabama, which taxes its poor more than twice as heavily as its rich, while holding a tight rein on education spending.

The poorest fifth of Alabama families, with incomes under $13,000, pay state and local taxes that take almost 11 cents out of each dollar. The richest 1 percent, who make $229,000 or more, pay less than 4 cents out of each dollar they earn, according to Citizens for Tax Justice, an advocacy group whose numbers are generally considered trustworthy even by many of its opponents.

Professor Hamill said what first drew her to the issue of fiscal policy and biblical principles was learning that Alabama timber companies, which own more than two-thirds of the land in the state, pay an annual property tax of only about 75 cents an acre.

“The Bible commands that the law promote justice because human beings are not good enough to promote justice individually on their own,” she said. “To assume that voluntary charity will raise enough revenues to meet this standard is to deny the sin of greed.”

Richard Teather, who teaches tax at Bournemouth University in Britain and has written on the moral dimensions of tax evasion, said that governments have publicly raised the issue of morals and taxes.

“The tax authorities say you have a moral duty to pay your taxes, but you cannot look at that in isolation,” Mr. Teather said. “Over here in Britain we have a lot of tax breaks for the very wealthy, which are not generally available to most people, and quite high level taxes for the middle and upper-middle classes, so this doesn’t look like a moral system.”

Professor Hamill, by her reading of the New Testament, concludes that at least a mildly progressive tax system is required so that the rich make some sacrifice for the poor. She cites the statement by Jesus that “unto whomsoever much is given, of him shall be much required, and to whom men have committed much, of him they will ask the more.”

Some of her critics, however, say that the tithes described in the Old Testament show that a flat tax, in which everyone pays the same share of their income to government, should be seen as the biblical standard.

Gary Palmer, president of the Alabama Policy Institute, agreed that taxes on the poor were much too high in the state, but said that the solution was not to raise taxes on the wealthy, but to lower them on the poor. He characterized Alabama’s sales taxes on food and medicine as immoral.

Some of Professor Hamill’s critics, in letters and e-mail to her and others, argue that she just wants to soak the rich, wrapping what they called her socialistic views in biblical cloth.

Until Professor Hamill focused on fiscal policies in light of Judeo-Christian moral principles, most scholarly work on religion and taxes was largely devoted to the issue of tax evasion. That was prompted, in part, by a 1992 updating of the Catholic catechism that listed tax evasion as a sin and by enforcement actions aimed at pacifists who refused to pay war taxes.

Professor Hamill said her research found that just one state, Minnesota, came within reach of the principles she identified, because its tax system is only slightly regressive and it spends heavily on helping the poor, especially through public education.

Copyright 2007 The New York Times Company. Reprinted from The New York Times, Business, of Tuesday, December 25, 2007.

| Wehaitians.com, the scholarly journal of democracy and human rights |

| More from wehaitians.com |