| Want to send this page or a link to a friend? Click on mail at the top of this window. |

| More Special Reports |

| Posted January 13, 2008 |

| YOUR MONEY |

Law Makes Debt Relief Harder for Homeowners |

|

|

|

JOEL PAGE FOR THE NEW YORK TIMES |

|

| Crystal Erickson and her sons Mun Luak, 1, and Ramkel Luak, 3, in Portland, Me. She and her fiancÚ face foreclosure on their home and are considering bankruptcy. |

By JANE BIRNBAUM |

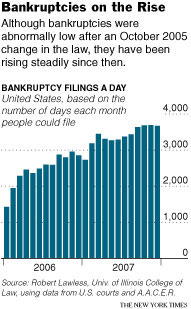

Bankruptcy filings began climbing last year, as the housing crisis and rising consumer debt began to take their toll.

Filings plummeted in 2006 after reaching unusual heights in 2005, when consumers rushed to declare bankruptcy before a tough new law took effect that October. Total filings of both consumer and business bankruptcies last year were still far below what they were in 2004, the last “normal” year.

Still, the number reached nearly 819,000 in 2007, according to Automated Access to Court Electronic Records, a bankruptcy data and management company in Oklahoma City. Mark Zandi, chief economist of Moody’s Economy.com, predicts it will exceed one million this year.

“The traditional reasons for bankruptcy — illness, divorce and job loss — haven’t gone away,” said Deborah K. Thorne, an assistant professor of sociology at Ohio University whose expertise is in consumer debt and bankruptcy. “With houses no longer A.T.M.’s for paying bills, that escape route is gone.”

Nevada, with 10,666 filings in 2007, had the highest year-over-year increase in bankruptcy filings, at 110 percent, according to court records that A.A.C.E.R. examined. California, the nation’s most populous state, was second with 70,638 filings, up 87 percent. With 38,981 total filings, Tennessee had the most per capita.

People have two main options in seeking bankruptcy protection. They can file under Chapter 7, the so-called fresh start, which eliminates many unsecured debts like credit card charges and medical bills. Or they can file a Chapter 13 reorganization plan, which allows them to save their homes and cars but often requires that they repay some unsecured debts.

Consumers who make more than their state’s median income must pass a means test to file for Chapter 7, a crucial new element of current bankruptcy law. “It is rare for a household with income less than $100,000 not to pass the Chapter 7 means test,” said Henry J. Sommer, president of the National Association of Consumer Bankruptcy Attorneys.

For those who do not pass the test, their only other bankruptcy remedy is usually Chapter 13.

According to an analysis of court records by Robert M. Lawless, a professor at the University of Illinois College of Law, about 30 percent of those filing for bankruptcy protection throughout 2004 chose Chapter 13. But last November, Chapter 13s accounted for almost 40 percent.

John Rao, a bankruptcy specialist and lawyer with the National Consumer Law Center in Boston, said he saw a spike six months ago in Chapter 13 filings because of consumers’ mortgage problems.

Professor Lawless, a bankruptcy specialist, also saw a connection between foreclosures and Chapter 13 filings. “The new law has contributed to a higher percentage of Chapter 13s, but the mortgage crisis undoubtedly plays a role,” he said. “Distressed homeowners traditionally file Chapter 13 to save their homes.”

In Las Vegas, Judge Bruce A. Markell of United States Bankruptcy Court has seen a larger percentage of Chapter 13s lately. But an increasing number are “placeholder” filings by consumers who have no possibility of affording their mortgages’ resetting interest rates, he said.

Unless a creditor is very diligent, a Chapter 13 filing stays a foreclosure for two or three months, Judge Markell explained: “The placeholder filing buys you time to time to maneuver, to find another location.”

But James F. Molleur, a bankruptcy lawyer in Saco, Me., said federal oversight, required under the new law, is also increasing the percentage of Chapter 13 filings, by focusing on debtors who file for Chapter 7. “The Department of Justice’s Trustee Program, which supervises bankruptcy law,” he said, “is conducting audits and investigations, looking for above-median-income debtors who file Chapter 7s and aggressively working to push them into Chapter 13s.”

Jane Limprecht, a spokeswoman for the United States Trustee Program at the Justice Department, said it had no comment on Mr. Molleur’s claim.

Legislation pending in Congress could spur still more people to choose Chapter 13 to save their homes. For primary residences, the bills would allow bankruptcy judges to lower interest rates and reduce values to the current appraisals. These powers are similar to those that bankruptcy judges have for other types of secured loans under Chapter 13.

|

“Current bankruptcy law makes it easier for debtors to keep vacation homes, investment property and yachts than it does for them to keep their residences,” said Mr. Sommer, of the bankruptcy lawyers’ association.

The financial services industry opposes the legislation. Steve Bartlett, president and chief executive of the Financial Services Roundtable, an association in Washington representing the nation’s largest lenders and securities dealers, said such changes would be “a disaster for both consumers and the economy” because they would drive up rates on new mortgages for everyone else and further disrupt the global securities market.

Proponents of the 2005 bankruptcy law say it is working. “For anybody who has real hardships and can’t repay their debts, the bankruptcy safety net remains as strong as ever,” Senator Charles E. Grassley, the Iowa Republican who sponsored the legislation changing the bankruptcy rules as a senior member of the Senate Judiciary Committee, said in an e-mail message.

“The reforms to bankruptcy law have helped ensure that people who are able to repay their debts are taking responsibility for at least some of their bills,” Senator Grassley said.

Lois R. Lupica, a professor at the University of Maine School of Law, argued that there have never been many abusers in the bankruptcy system. “What reform — and I use that word loosely — did was to make bankruptcy more expensive and cumbersome to file, and to scare people away from it.”

Professor Lawless said that with consumers’ debts higher than ever, “only the increased cost of filing bankruptcy under the new law” explains why there are fewer filings than under the old law. The new law’s ambiguities, as well as increased liability for lawyers and demands for more paperwork on short deadlines, have pushed up legal fees considerably, he said.

“You have to pay for Chapter 7 legal fees upfront in cash,” he said. “You can be too poor to go bankrupt.”

Judge Markell in Nevada said the normal fee for a Chapter 13 in Las Vegas is now around $4,300, up from about $2,700 before the new law.

Chapter 13 may be the only remedy for wealthy consumers whose homes are worth less than they owe or who have unmanageable unsecured debts. “Some considering bankruptcy will be shocked to find they may not be able to get a clean slate under the new law,” said Jeffrey S. Conner, a San Francisco real estate lawyer.

Not everyone who wants a Chapter 13, which has always had debt limits, can get one. “It’s easy to be over the caps with home prices in places like California, and people who can no longer file a Chapter 7 are neither fish nor fowl,” said David A. Tilem, a bankruptcy lawyer in Glendale, Calif. Their only bankruptcy remedy is a pricey plan under Chapter 11, which is used mostly by businesses.

Edward Alexander, 42, a Maine Army National Guard recruiter in Sanford, Me., decided to declare bankruptcy last year after a lender foreclosed on his house in Key West, Fla. The house had a $300,000 appraised value, $100,000 less than Mr. Alexander owed.

“I panicked,” he recalled. “I figured the lender was going to come after me hard.”

Pushed over Maine’s median income by his National Guard per diem, Mr. Alexander passed the means test for a Chapter 7. But Mr. Molleur advised him to make a filing under Chapter 13, through which he will pay a total $2,000 over five years on the $100,000 delinquency and avoid tax liability on it. “I feel like the lead balloon over my head has gone away,” Mr. Alexander said.

Mr. Molleur has a different take. “The Trustee Program feels vindicated by having more Chapter 13s to pad their statistics,” he said, “but many unsecured creditors do not really benefit.”

Joseph Giacobbe, a mortgage specialist in Manhattan, and his wife felt the long arm of the United States Trustee Program after filing for Chapter 7 last April. They sought relief from $69,000 in unsecured debt, including $52,000 in credit card bills, partly incurred when the couple quit their jobs to care for Ms. Giacobbe’s ailing parents.

Filing for bankruptcy has been a nightmare, Mr. Giacobbe said.

From his experience in the mortgage business, Mr. Giacobbe said he believed that only a Chapter 7 would help the couple’s beleaguered credit scores recover quickly.

About two weeks after filing, the Giacobbes learned they were being audited at the direction of the Trustee Program, their lawyer, Stephen G. Doherty of Doylestown, Pa., said.

Ultimately, the Trustee Program argued that based on the couple’s income and expenses, the couple did not qualify for a Chapter 7. Rather than fight the federal government in court, the Giacobbes voluntarily converted to a Chapter 13. A judge dismissed the Giacobbes’ case on Wednesday after a trustee said payments had not arrived, and Mr. Doherty is now working to have the case reinstated.

Crystal Erickson, 33, an artist and teacher in Portland, Me., is considering bankruptcy as she tries to communicate with her lender about a two-family dwelling she and her fiancÚ, Dobol Luak, 34, a student, bought in September 2004. Ms. Erickson said the couple were not informed that they were taking out an interest-only loan with resetting interest rates.

The couple managed to make payments after the first reset but could not afford them after the second one last summer. The lender moved to foreclose late last year.

In a Chapter 13 case, a judge can change the terms of a loan for consumers who were victims of predatory lending.

“We don’t want to move,” Ms. Erickson said. “We’re part of this community, and from working with kids who live in public housing, I see that communities are created or destroyed depending on whether people have ownership in their homes.”

Mike Henry, 48, a maintenance technician and single father from Madisonville, Tenn., said he reluctantly filed for Chapter 7 protection last year after spending most of his savings to pay medical bills. His legal fees were $1,350 and his court costs were $299.

“I felt a little relieved, but mostly guilty because I’ve always paid my debts all my life,” Mr. Henry said.

Copyright 2008 The New York Times Company. Reprinted from The New York Times, Business Day, of Saturday, January 12, 2008.

| Wehaitians.com, the scholarly journal of democracy and human rights |

| More from wehaitians.com |