| Want to send this page or a link to a friend? Click on mail at the top of this window. |

| Posted October 22, 2006 |

ECONOMIC VIEW |

|

________________ |

|

ANNA BERNASEK |

|

| An Early Calculation of Iraq's Cost of War |

HERE’S a basic question: What has been the cost of the Iraq war for Iraq? As it turns out, it’s not easy to find an economist who can provide an answer. Although several studies have dealt with the war’s cost to Americans, there has been no comparable work addressing the cost to Iraqis.

Of course, the loss of human life has always been evident. Recently, the United Nations estimated that 100 Iraqis were dying each day, on average, as a result of the war. Others have put the number much higher. A recent study in The Lancet, the British medical journal, placed the average daily figure at about 500, amounting to the loss of 2 percent of Iraq’s population since the invasion in March 2003.

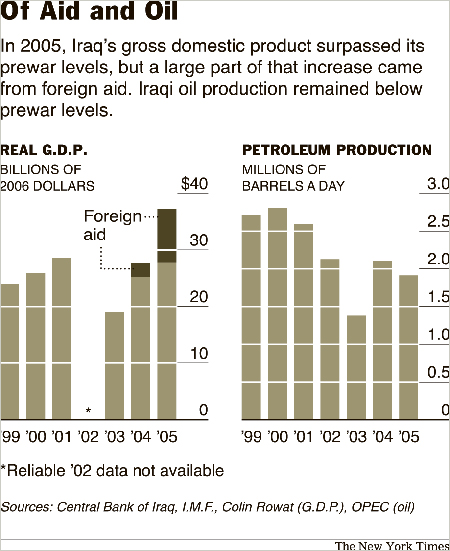

The economic cost has been less visible. Published information on the subject is very limited, although one economist, Colin Rowat, has made some preliminary calculations using the best sources available. Professor Rowat, a specialist on the Iraqi economy at the University of Birmingham in Britain, relied mainly on data from the International Monetary Fund to estimate the war’s overall effect on the Iraqi economy. His calculations are a work in progress, but what he has found so far is sobering: the cost amounts to a cut of at least 40 percent in Iraq’s national income.

Professor Rowat looked at the six-year stretch from 2000 to 2005 and divided it into thirds. During the first period, 2000-2001, United Nations trade sanctions against Iraq were beginning to crumble; the Security Council lifted the cap on Iraqi oil sales to the rest of the world, and the Iraqi government was becoming adept at getting around the remaining trade restrictions. The second period, 2002 -2003, covers the buildup to war and the invasion itself. The last period, 2004-2005, covers post-invasion years when sanctions were removed.

Professor Rowat made several kinds of calculations. First, he estimated the actual change in the size of Iraq’s economy. Then he considered the economic effects of foreign aid in 2005, much of it from the United States. (Because foreign aid is regarded as temporary and is expected to taper off, he said, excluding it reveals Iraq’s underlying economic performance.)

|

Finally, he estimated how the economy might have performed had the war never happened. This last estimate, of course, depends on a host of assumptions, as Professor Rowat would be the first to say. He assumed, for example, that in the absence of war, Iraq’s economy would have been driven by the price of oil. Oil prices are, in fact, crucial to Iraq; according to the World Bank, oil revenue represents 60 percent of the total economy. Professor Rowat also assumed that the economy would have grown from 2002 to 2005 as it did from 2000 to 2001 — at a pace equal to 71 percent of the rate of increase in world oil prices. Of course, some of the oil-price increase in recent years must be attributed to the Iraq war itself; Professor Rowat acknowledged this but did not attempt to remove that factor from these rough calculations.

He readily acknowledged the difficulty of coming up with an undisputed set of figures; nevertheless, his analysis is at least a starting point.

Looking first at the actual Iraqi economy, he calculated that it may have grown 3.1 percent a year, on average and after adjusting for inflation, from 2000 through 2005. When he subtracted foreign aid from that total, however, he found that the economy actually contracted 0.2 percent a year over the same period. He said aid was especially crucial in 2005, when it kept the economy afloat.

Finally, based on the steep rise in oil prices, he estimated that without a war and with steady oil production, Iraq would have grown 12 percent a year after adjusting for inflation. That rate would have made Iraq one of the fastest-growing economies in the world, albeit one that was expanding from a very small economic base.

How realistic is this projection? It’s hard to say, because so much of it depends on oil economics. Still, the I.M.F. has concluded that the Iraqi economy has the capacity to grow very quickly — under the right conditions. It now forecasts Iraq’s real growth over the next five years at an annual rate averaging better than 10 percent.

Using Professor Rowat’s calculations, what might the economic cost of the war be for Iraq? If there had been no war, Iraq’s economy in 2005 might have amounted to $61 billion in today’s dollars, compared with the actual $37 billion, he estimates. That works out to a loss of $24 billion because of the war. Excluding foreign aid from the calculations, the loss estimate is around $30 billion.

Consider the more conservative figure, $24 billion. It amounts to a 40 percent cut in gross domestic product per capita — an average loss of around $900 for each Iraqi in 2005.

Straightforward comparisons with the United States aren’t possible, but rough estimates of the war’s overall cost to Americans are in the neighborhood of $1 trillion over a 10-year period. That works out to around 1 percent of the nation’s income during that period.

FOR Iraq, there is no doubt that continuing violence and turmoil are hurting the economy. The I.M.F. stated in a report in August that Iraq’s growth was coming from the non-oil economy and that oil production was expected to remain flat this year. Iraq’s oil production has not yet returned to prewar levels. The I.M.F. attributed the lack of progress in the oil sector to the violence, which is preventing much-needed investment, and to infrastructure problems.

While Professor Rowat’s calculations represent just one economist’s efforts to wrestle with extremely limited data, his work may encourage others to follow. Assessing the war’s economic cost for Iraq, of course, doesn’t provide an answer to whether the war is worthwhile in the long run. But it does provide a clue.

Copyright 2006 The New York Times Company Privacy. Reprinted from The New York Times, Sunday Business, of Sunday, October 22, 2006.

| Wehaitians.com, the scholarly journal of democracy and human rights |

| More from wehaitians.com |