| Want to send this page or a link to a friend? Click on mail at the top of this window. |

More Special Reports |

| Posted March 26, 2008 |

A Political Comeback: Supply-Side Economics |

|

|

|

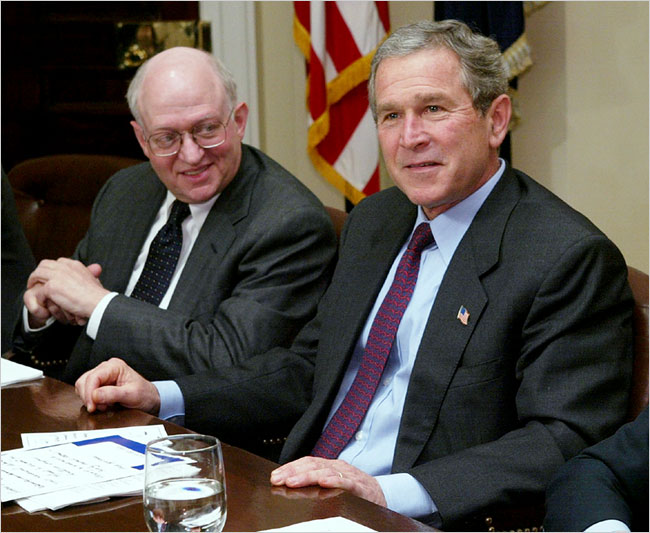

ALEX WONG/GETTY IMAGES |

|

| President Bush, at right, meeting with Martin Felstein, a Harvard economist, in 2003. |

By LOUIS UCHITELLE |

When Ronald Reagan ran for president in 1980, he promised to cut taxes in what seemed, at the time, a magical way. Tax revenue would go up, not down, he said, as the economy boomed in response to lower rates.

Since then, supply-side economics, as it was called — first with derision but then as a label embraced by its supporters — has become a central tenet of Republican political and economic thinking. That’s despite the fact that the big supply-side tax cuts of the 1980s and the 2000s did not work out as advertised, as even most supporters acknowledge. But advocates see broader economic benefits from lowering tax rates, which is one of the reasons the concept has reappeared as a point of contention in this year’s election campaign, in an amended form.

|

“What really happens is that the economy grows more vigorously when you lower tax rates,” said Kevin Hassett, an adviser to the presumptive Republican nominee, John McCain, and the director for economic policy studies at the conservative American Enterprise Institute. “It is beyond the reach of economic science to explain precisely why that happens, but it does.”

Even with a growing economy, however, the promised boon in tax revenue never materialized. Arthur B. Laffer, the renowned proponent of supply-side economics, still holds that tax revenues “rise dramatically” when tax rates are cut.

In the 1980s, though, during the initial era of supply-side tax cuts, per capita revenue from personal income taxes, adjusted for inflation, rose an average of just 0.7 percent annually throughout the Reagan presidency, according to the White House Office of Management and Budget.

That was far below what turned out to be an average annual increase of 6.5 percent in the eight years of the Clinton administration, when tax rates at the high end of the income ladder were raised.

|

THE ASSOCIATED PRESS |

| David Stockman, left, Donald Regan and Mr. Feldstein before testifying on President Reagan's budget in 1984. |

Since 2001, the annual per capita revenue from income taxes fell 1 percent under President Bush even though tax collections picked up sharply starting in 2005. The budget surplus Mr. Bush inherited turned into a deficit.

“If you are cutting taxes without offsetting the cuts through reductions in spending, then all you are doing is increasing the debt and postponing the taxes,” said Jason Furman, director of the Hamilton Project at the Brookings Institution, and also a policy adviser to the Democratic presidential candidates.

Circumstances vary across the decades, of course, and it is difficult to sort out all the various influences on the economy and tax revenues. But when Mr. Reagan and his supply-side advisers first pushed through a range of tax cuts, they applied their logic to the broad mass of taxpaying workers. They argued that the incentive from lower rates on additional increments of income would prompt people to work that extra day or get more education to qualify for a better job.

Similarly, a spouse might take a new job, encouraged to do so by the promise of more take-home pay. The family’s taxable income, and the nation’s, would grow, the theory suggested, producing more tax revenue even at the lower rate.

That was before so much more of the national income flowed to upper-end households, and before the actual tax collections of the last three decades undercut the supply-side argument. Now the supply-siders single out the wealthiest Americans and argue that because they have so many ways to shelter their money from taxes, the incentive to declare more taxable income is much greater when tax rates are lowered than it is for the less well-to-do.

“The supply-side argument these days really applies to upper-income people,” said Robert M. Solow, a Nobel laureate in economics who served in the Kennedy administration. “They are portrayed as the golden geese, and you don’t want to discourage them from laying their eggs.”

By contrast, Mr. Solow says, “the Democrats are convinced they’ll lay their eggs anyway, without tax cuts as an incentive.”

Senators Hillary Rodham Clinton and Barack Obama, contending for the Democratic presidential nomination, reflect that point of view. They say that they have no intention of undoing the Bush tax cuts on families earning less than $250,000 a year. Married couples with incomes above that level, however, would once again be taxed by either candidate at up to 39.6 percent — the top rate reached during Bill Clinton’s presidency.

President Bush pushed through legislation in 2003 that cut the top rate to 35 percent, but only until 2011. Senator McCain wants to extend the 35 percent rate indefinitely and his camp increasingly cites as justification the supply-side effect on upper-income families.

Having once voted against the Bush cuts, Mr. McCain has reversed position and now has even enlisted Mr. Laffer as a special adviser. “McCain is on the right track,” Mr. Laffer said.

While Mr. Laffer insists that tax revenue will rise when tax rates are cut, other supply-siders are less categorical. Martin Feldstein, a Harvard economist who was the first chairman of President Reagan’s Council of Economic Advisers and now supports Senator McCain, estimates that a 10 percent tax cut would in fact reduce tax revenue — but only by 3 to 5 percent.

“It is not that you get more revenue by lowering tax rates, it is that you don’t lose as much,” he said.

Not since Mr. Reagan ran in 1980 have supply-side tax cuts been so central a campaign issue. George H. W. Bush and Bill Clinton each ended up raising taxes, ignoring the supply-side thesis, which the elder Mr. Bush once called “voodoo economics.”

Now his son argues that his tax cuts strengthened the economy. Growth resumed after Mr. Bush pushed his tax cuts through Congress, but that position, critics say, is harder to maintain now, given that the election campaign is unfolding in the midst of a credit crisis and an incipient recession.

|

PATRICK ANDRADE FOR THE NEW YORK TIMES |

| Jason Furman of the Hamilton Project, advises Democrats. |

Still, even in hard times, the incentive from a tax cut is particularly strong among the wealthy, supply-siders say. A drop of four or five percentage points in the top tax rate of these households saves them tens of millions of dollars. Above all, the supply-siders say, less money will be wasted on accountants and lawyers hired to find ways to dodge taxes when the rates were higher. These outlays will be put to more productive use.

The supply-siders also argue that at the corporate level, lower tax rates, which Senator McCain favors, prompt companies to hire more workers and to invest in new equipment, generating more output and more taxable income.

The Democrats, and many economists who describe themselves as nonpartisan, have a different perspective. Tax incentives might indeed increase labor supply and output, they acknowledge, but what good is that if there is insufficient demand for the additional labor and for the goods and services that are produced?

|

BUSINESS WIRE |

| Arthur B. Laffer helped establish supply-side economics. |

The Democrats are quick, as a result, to support the $160 billion stimulus package, with its rebate checks that millions of Americans will be encouraged to spend, supporting demand. They also are prepared to raise taxes to introduce more equity into the tax system and as a means of shrinking or eliminating a large budget deficit.

The excessive borrowing required to finance the deficit, they say, acts as a drag on the economy, pushing interest rates higher than they otherwise would be, adding to the cost of business investment.

Gene Sperling, an economic adviser to Bill Clinton during his administration and now to Mrs. Clinton as a candidate, said that supply-siders vastly exaggerate the incentive effect of relatively small changes in tax rates while ignoring the benefits of bringing government revenue more closely in line with spending.

“The supply-siders predicted in the 1990s that raising rates, even for deficit reduction, would lead us to recession,” Mr. Sperling said. “What followed instead was the longest recovery in history, and the people whose tax rates went up had exceptional income gains.”

The tax issue, for all its importance, does not yet have a prominent place in the campaign. That is mainly because Senators Clinton and Obama are still struggling with each other on issues other than taxes, on which they generally agree. A winner has not emerged to cross swords with Senator McCain.

“When there is finally a candidate,” said Austan D. Goolsbee, chief economic adviser to Senator Obama, “then we’ll debate taxes and the flaws in the supply-side argument.”

Copyright 2008 The New York Times Company. Reprinted from The New York Times, Business, of Wednesday, March 26, 2008.

| Wehaitians.com, the scholarly journal of democracy and human rights |

| More from wehaitians.com |